6 Easy Facts About Financial Education Explained

Wiki Article

Not known Details About Financial Education

Table of ContentsThe 30-Second Trick For Financial EducationThe 3-Minute Rule for Financial EducationNot known Incorrect Statements About Financial Education The Financial Education PDFsSome Known Questions About Financial Education.10 Easy Facts About Financial Education ExplainedThe 15-Second Trick For Financial Education

It is extremely hard to gauge the amount as well as intensity of personal money direction that is taking place in people's residences, as well as purposeful data on this subject is tough to obtain for the countless primary and center colleges across the nation. Best Nursing Paper Writing Service. Clear-cut college information is similarly hard to discover in this location.In the area of this report entitled "Bonus Credit score: State Policies as well as Programs That Are Making a Difference," we try to offer you a small sampling of the numerous state campaigns that are trying to bring personal financing ideas to K-8 kids and also to young adults in college or the work environment.

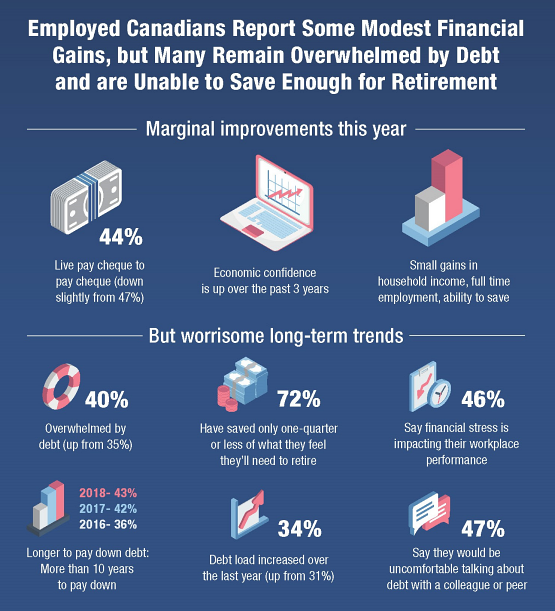

Kids are not finding out about personal finance in your home. A 2017 T. Rowe Cost Survey noted that 69% of parents have some hesitation about discussing financial matters with their children. 3 In reality, parents are almost as uneasy speaking to their kids regarding sex as they have to do with money. Only 23% of kids surveyed suggested that they talk with their moms and dads regularly about money, and 35% mentioned that their moms and dads are uncomfortable talking with them regarding money.

About Financial Education

Having an exceptional credit rating can save a consumer over of a $100,000 in interest payments over a life time (see: 's Life time Expense of Financial Obligation Calculator). Financial literacy leads to much better individual financing behavior. There are a variety of researches that suggest that individuals with higher degrees of monetary literacy make much better personal finance choices.

It was discovered that mandated individual money education and learning in high institution improved the credit rating as well as reduced the default prices of young people. There was no measurable modification in the surrounding states over the exact same amount of time gauged. One more research shows that a well-designed individual financing program (one semester in size), instructed by very trained educators that went to a 30-hour week-long training program and also utilized a specific educational program, enhanced the ordinary personal money knowledge of the pupils in all common and principle areas covered by the scientists' assessment exam (Asarta, Hill, as well as Meszaros, 2014).

A Biased View of Financial Education

Additionally, pupils who got formal education and learning by trained teachers reported some enhancement in a lot of individual finance behaviors measured. Pupils that obtained individual financing education and learning by trained teachers had "high economic proficiency" on the same level with the proficiency degrees of Generation X (ages 35 to 49) and also greater than that of older Millennials (ages 18 to 34) (Champlain University's Center for Financial Proficiency, 2015).We would certainly not enable a young adult to get in the chauffeur's seat of a vehicle without needing driver's education, and also yet we enable our young people to get in the intricate monetary world without any associated education. An uneducated specific armed with a bank card, a trainee funding as well as access to a home mortgage can be virtually as hazardous to themselves as well as their community as an individual without any training behind the wheel of an automobile.

Throughout the Federal Reserve System, we collaborate with the Jump$sharp Union-- in your area with the Washington, D.C., phase and via alliances in between the Book Banks and various other state chapters of the union-- to achieve our common goals. The collaboration in between the Federal Book and also the Jump$sharp Coalition is a natural one. Leap$tart's objective to establish a more financially literate populace supports the Federal Book's objective of a stable and also growing economic situation.

Financial Education for Dummies

As students independently create homes or start services, their cumulative decisions will shape the economic situation of our future. I am specifically delighted to be able to stand for the Federal Reserve in this effort as my personal dedication to financial literacy has covered greater than three decades. I have actually been involved with a variety of campaigns including some that took me into the classroom to show pupils straight and also others that supplied educators with devices and also training to weblink better prepare them to teach business economics and also individual money.They require to understand just how to budget and save and also just how to choose the finest investment cars for their cost savings. And as the recent financial turmoil has educated us, they have to recognize just how to plan for as well as take care of monetary backups such as joblessness or unforeseen expenses (Best Nursing Paper Writing Service). Leap$sharp assistances initiatives to supply such an education.

In addition to giving materials for financial education and learning, the Federal Book has also begun to assess the performance of the education and learning programs it takes part in, so that we can better examine the results of our efforts. This study is meant click for info to assist us much better answer the inquiry, "What operates in education?" so that we might designate our resources in the ideal possible manner.

The Definitive Guide to Financial Education

The Federal Book is the key government company billed with composing rules regulating customer economic products. Historically, we have actually concentrated on disclosure as the most effective method to give customers with information to select in between items or to choose concerning utilizing monetary items. Over the last few years, we have made use of extensive consumer screening to assess customers' understanding of monetary disclosures and also to highlight practices that simply can not be comprehended by customers despite the ideal disclosures.Lately, the Federal Reserve has written strong brand-new customer protection guidelines for mortgages, credit score cards, and overdraft charges. And we have enhanced our feedback time for drafting rules to deal with emerging fads that may pose new risks for customers. In closing, I would love to say thanks to the teachers right here today for your commitment to Washington-area students.

I delight in to go to this site be a component of this discussion amongst the personal as well as public fields, along with the education and learning neighborhood, regarding how finest to equip trainees with the confidence and also savvy to browse their economic globes.

6 Easy Facts About Financial Education Shown

For better ideas for local business owner, comply with Every, Income on Facebook, Twitter, as well as Linked, In.

Some Known Details About Financial Education

By- Payal Jain, Owner and CEO, Funngro As a young adult, have you ever seen your parents going over something pertaining to money, as well as when you attempt to join the conversation, they either change the subject or claim something like "we are doing something important, don't interrupt". The majority of us question why they do this, why can not we know about cash? Well, you are not exactly economically literate, so rather truthfully, they assume it would be of no help presently.Report this wiki page